Company formation in Andorra

Want to open a company in Andorra? We’ll guide you.

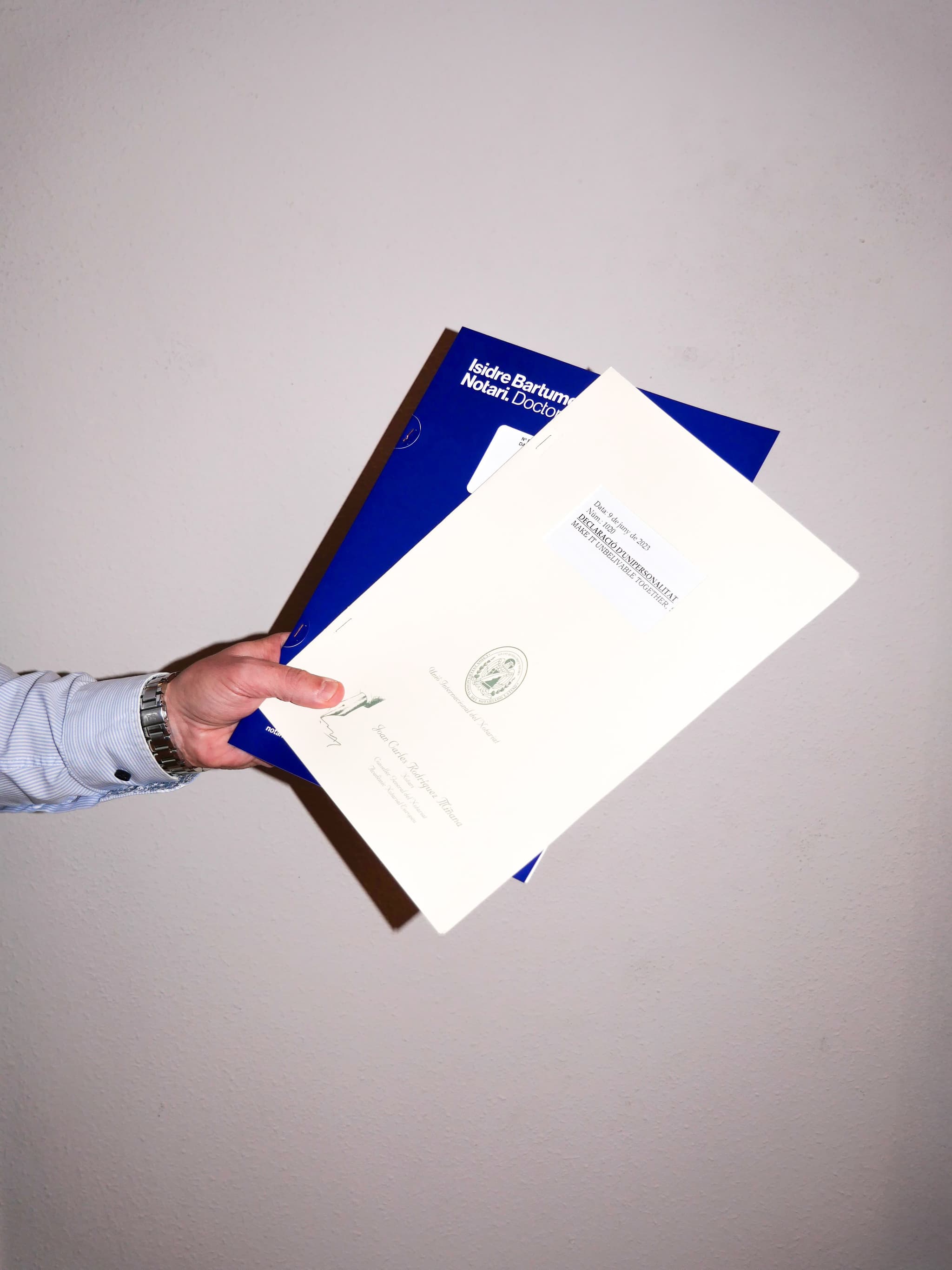

If you're a foreigner looking to set up an Andorran company with more than 10% ownership, you’ll need foreign investment authorization. This step is mandatory and must be submitted correctly to avoid delays or rejections.

At Gestoria Bon Consell, we help you:

- Determine which type of company best suits your project.

- Prepare all necessary documents: certificates, business plan, company structure, etc.

- Handle the application and follow-up with the Government of Andorra until final approval.

We can also advise you on minimum capital, tax obligations, estimated timelines, and the next steps to operate legally. We manage the entire process, from planning to registration with the Companies Register.

I want more information

Each of these activities requires permits. We prepare them for you.

For any business activity in Andorra, whether open to the public or not, it is necessary to process administrative and commercial licenses or authorizations. We take care of everything: declarations, procedures, and follow-up of the formalities until the necessary authorization is obtained.

Includes:

- Application for license or activity registration.

- Submission of required documents to the Government or Local Council.

- Registration with the Commerce and Industry Registry according to the activity carried out.

Do you want to export your project abroad? We help you make it happen.

If you want to open a branch or company in another country, and international management and local regulations overwhelm you, we offer a network of services (management offices, lawyers) in various jurisdictions to coordinate everything from the opening to legal compliance. We collaborate with local experts so your project avoids surprises and works from day one.

Our service includes:

- Advice on the best legal and tax approach for your case.

- Coordination with accredited local professionals (management offices, advisors, or notaries).

- Document review, legalization, and requirements for bank and tax registration.

- Follow-up until the company is fully operational.

Useful tips to better manage your finances

Sign up for our newsletter and receive useful articles on taxation, administrative procedures, and personal finance.